Draw Vs Salary

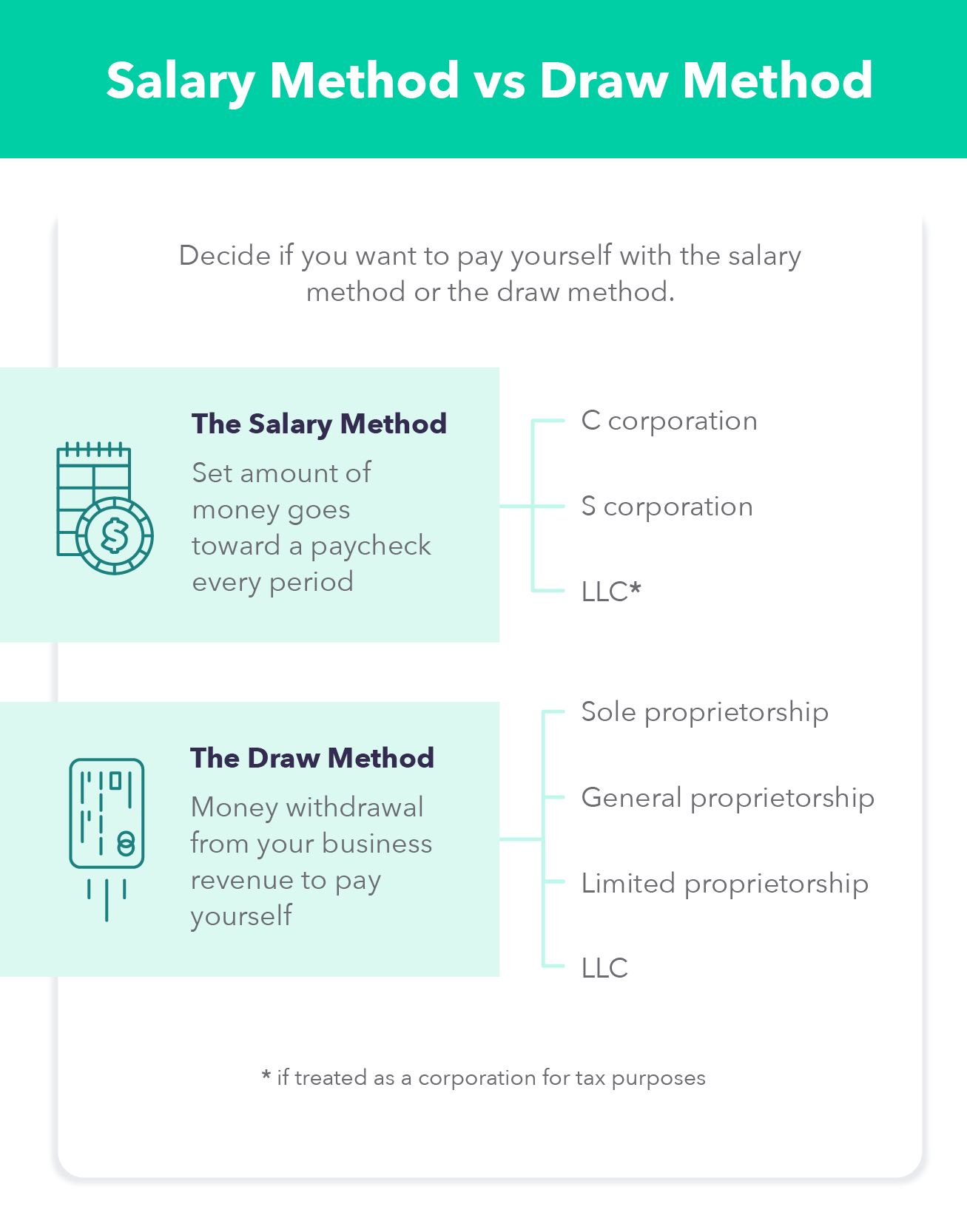

Draw Vs Salary - An owner’s draw provides more flexibility — instead of. Each method has advantages and disadvantages,. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. Web one of the main differences between paying yourself a salary and taking an owner’s draw is the tax implications. Web the two main ways to pay yourself as a business owner are owner’s draw and salary; The owner’s draw method and the salary method. Web the two main ways of paying yourself as a business owner are an owner's draw or taking a salary. Web owner's draw vs. How to pay yourself as a business owner. July 17, 2024 10:39 pm pt. The business owner takes funds out of the. Typically, owners will use this method for. But how do you know which one (or both) is an option for your business? Each method has advantages and disadvantages,. Your two payment options are the owners' draw method and the salary method. With the draw method, you can draw money from your. Web two basic methods exist for how to pay yourself as a business owner: An owner’s draw or a salary. Web owner's draw vs. Web understanding the difference between an owner’s draw vs. Web owner's draw vs. But how do you know which one (or both) is an option for your business? Web owners' draw vs salary: Each method has advantages and disadvantages,. However, anytime you take a draw, you. July 17, 2024 10:39 pm pt. Being taxed as a sole proprietor means you can withdraw money out of business for your personal use. In the former, you draw money from your business. Web two basic methods exist for how to pay yourself as a business owner: With the draw method, you can draw money from your. 774k views 3 years ago 2022 payroll guide with hector garcia | quickbooks how to series. Being taxed as a sole proprietor means you can withdraw money out of business for your personal use. Web this article will break down owners draw vs salary, looking at the pros and cons of each payment method to help you determine the right. An owner’s draw provides more flexibility — instead of. Web understanding the difference between an owner’s draw vs. Web two basic methods exist for how to pay yourself as a business owner: But how do you know which one (or both) is an option for your business? There are two main ways to pay yourself: An owner's draw is a way for a business owner to withdraw money from the business for personal use. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. Web two basic methods exist for how to pay yourself as a business owner: However, anytime you take a draw, you. They have different tax implications. An owner’s draw or a salary. Every business owner needs to. Web as the owner, you can choose to take a draw if your personal equity in the business is more than the business’s liabilities. Web the two main ways of paying yourself as a business owner are an owner's draw or taking a salary. Web the two main ways. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. Web you can consider two standard compensation methods: The business owner takes funds out of the. Web understanding the difference between an owner’s draw vs. The business owner takes funds out of the. Understand how business classification impacts your decision. Each method has advantages and disadvantages,. The business owner takes funds out of the. Web as the owner, you can choose to take a draw if your personal equity in the business is more than the business’s liabilities. They have different tax implications and are reserved. December 07, 2021 • 4 min read. There are two main ways to pay yourself: Understand the difference between salary vs. The business owner takes funds out of the. Understand how business classification impacts your decision. An owner’s draw or a salary. They have different tax implications and are reserved. The owner’s draw method and the salary method. An owner’s draw provides more flexibility — instead of. With the draw method, you can draw money from your. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. Each method has advantages and disadvantages,. Web you can consider two standard compensation methods: But how do you know which one (or both) is an option for your business? The business owner takes funds out of the. Learn more about owner's draw vs payroll salary. Web up to $32 cash back is it better to take a draw or salary? Understand how business classification impacts your decision. 774k views 3 years ago 2022 payroll guide with hector garcia | quickbooks how to series. Being taxed as a sole proprietor means you can withdraw money out of business for your personal use. Typically, owners will use this method for.What Is A Draw Vs Salary Warehouse of Ideas

How to Pay Yourself ? Owner’s Draw vs. Salary. Aenten US

What Is A Draw Vs Salary DRAW IT OUT

Entrepreneur Salary 5 Steps to Paying Yourself First MintLife Blog

How Should I Pay Myself? Owner's Draw Vs Salary Business Law

Owner's Draw vs. Salary Your Pay Decisions XOA TAX

Owner's Draw vs. Salary How to Pay Yourself in 2024

Owner’s Draw vs. Salary What’s the Difference? 1800Accountant

What Is A Draw Vs Salary DRAW IT OUT

In The Former, You Draw Money From Your Business.

An Owner's Draw Is A Way For A Business Owner To Withdraw Money From The Business For Personal Use.

Web Understanding The Difference Between An Owner’s Draw Vs.

However, Anytime You Take A Draw, You.

Related Post: